5 Top Performing Smallcap Stocks In 2023

5 Smallcap Stocks that Started 2023 with a Bang. Here’s What You Need to Know About Them…

“Doobte ko tinke ka sahara”.

This is a famous proverb. It means that even a little help of a straw is worth more to someone who is drowning in an ocean of difficulties.

The proverb holds true for an investor’s stock market portfolio. A portfolio drowning in overall negative market sentiment can be saved by one stock that is doing well against all odds.

The overall market sentiment in Indian share markets is dull right now because of the Adani-Hindenburg saga.

The Union Budget also failed to cheer investors…

In this tough situation, there are some stocks that have surprised investors and delivered substantial gains.

Select small-cap stocks in particular have seen a decent rise. Let’s take a look at the top smallcap gainers in 2023 so far.

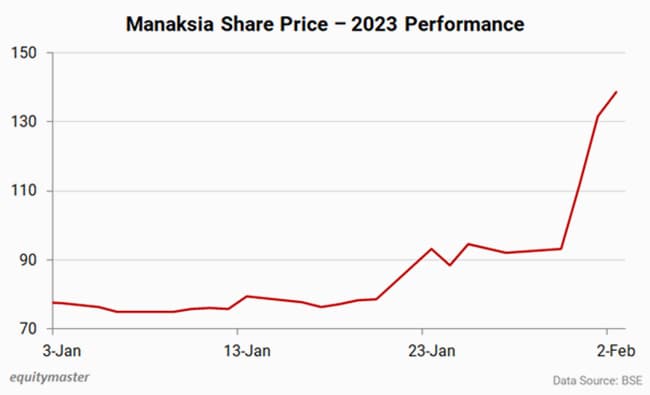

#1 Manaksia

Manaksia was originally incorporated as Hindusthan Seals on 27 December 1984. The company specialises in the manufacture of packaging products (crowns, closures, and metal containers), metal products and fast-moving consumer goods, among others.

So far in 2023 (up to 01 February), Manaksia share price has rallied 77%. This rally is in sharp contrast to the overall gains that the company saw in 2022. In 2022, the share price went up by a measly 2%.

On Wednesday last week, stock exchange sought clarification from Manaksia with reference to significant movement in price, in order to ensure that investors have latest relevant information about the company.

On Thursday the company replied saying it has complied with all the requirements and has not withheld any information which may impact the share price.

We’ll have to wait a couple more days to find out the real reason…

#2 Transformers and Rectifiers (India)

Transformers and Rectifiers (India) (TRIL) is a leading manufacturer of transformers up to 1,200 kV class.

TRIL has a wide range of transformers, like power & distribution transformers, furnace transformers, rectifier transformers & special transformers. It has strong in-house design & technical expertise; combined with technical collaboration/JV relationship for 765 kV transformers & reactors.

Up until 01 February 2023, TRIL share price has gained 26% in 2023.

In 2022, TRIL share price rose by 51%.

The recent rally is on the back of healthy growth prospects. Market experts believe that a robust outlook coupled with an all-time high order backlog will allow TRIL to post a robust performance, going ahead.

#3 VLS Finance

VLS Finance is a reputed name in the finance industry. Established in 1986, VLS Finance is a multi-faceted, multi-divisional, integrated financial services group.

It provides various services like asset management, strategic private equity investments, arbitrage, and investment banking.

VLS Finance share price has rallied 33% so far in 2023. This is in sharp contrast to its performance in 2022. In 2022, VLS Finance fell by 29%.

On 5 January 2023, the company’s board approved a buyback of shares. When the buyback was announced, VLS Finance share price closed at Rs 160.5 while the buyback price was fixed at Rs 200 per share.

Investors saw an arbitrage opportunity of buying the shares at lower price and then selling the shares back to company at higher price. VLS Finance shares were in high demand, hence the steep rise in its share price.

#4 Surya Roshni

Surya Roshni is a multinational company headquartered in Delhi, India. The company produces fans, steel, lighting, LED, kitchen appliances, and PVC pipes.

Surya Roshni exports its products to more than 44 countries. They are one of the top manufacturers of LED lights in India.

So far in 2023 (up to 01 February), Surya Roshni share price has surged 31%. In 2022, the company registered a muted performance.

A healthy business outlook is driving the rally it seems. The company is expected to receive a boost because of the increasing focus of the government in the electronics sector.

The government has taken various initiatives like ‘Aatma Nirbhar Bharat Abhiyaan’, ‘Vocal for Local’, and the PLI scheme for LED lighting products/components.

Surya Roshni saw a favourable demand outlook for PVC due to the government initiatives such as Housing for All, ‘Nal se Jal’, Project AMRUT, and Swachh Bharat Mission.

The demand outlook for non-agricultural pipes appears to be good, as the major urban real estate markets show signs of a sustained recovery.

#5 RateGain Travel Technologies

RateGain Travel Technologies is one of the leading distribution technology companies globally and the largest software as a service provider in the travel and hospitality industry in India.

The firm offers travel and hospitality services across different verticals like hotels, airlines, online travel agents, meta-search companies, package providers, car rentals, cruises, and ferries.

So far in 2023, RateGain Travel Technologies’ share price has gained 21%.

Even the best IT stocks witnessed a selloff in 2022 and they’re still not out of the woods yet. Similarly, new age tech companies were also hammered.

RateGain Travel Technologies was not an exception and lost 22% in 2022.

In 2023, RateGain Travel Technologies share price has moved out of its consolidation zone.

Also, on 9 January 2023, the company announced that it has entered into a definitive agreement to acquire Adara Inc. through an asset purchase agreement.

Adara Inc is one of the world’s largest travel data exchange platforms, providing access to permissioned and ethically sourced intent data.

The acquisition is aligned with RateGain’s vision of building an integrated Revmax platform, focused on customer acquisition and wallet share expansion. It will help build one of the largest and most comprehensive sources of travel intent data in the world that is permissioned and ethically sourced.

Which other smallcap stocks are off to a great start in 2023?

Apart from the above, here are other smallcap stocks which have started on a decent note.

Investment Takeaway

In conclusion, the recent rally in these small-cap stocks in 2023 has attracted attention from investors. However, it is important to exercise caution and keep an eye on these stocks, especially in light of the ongoing Adani Hindenburg saga.

While short-term gains may be attractive, it is crucial to carefully assess the potential risks and long-term viability of these investments before deciding.

Investing always involves a certain degree of risk, and it’s crucial to weigh the pros and cons before taking the plunge.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com