Dolly Khanna Portfolio: Top 5 Stocks

If you can successfully impersonate Bollywood celebs, you may be able to make a nice living from standup shows, but not enough to retire rich.

But you might be able to make a fortune if you develop a talent for mimicking gurus in the stock market.

Over the past decade, imitation of financial gurus’ portfolios has been increasingly popular.

The primary idea behind this strategy is to look at the buying and selling behavior of investing gurus and base personal investment decisions on that.

One such guru that has often been under the radar of retail investors is Dolly Khanna.

Dolly Khanna is renowned for choosing undervalued midcaps and smallcaps that are not well known known. She has been trading in equities since 1996.

Dolly Khanna’s portfolio is managed by her husband, Rajiv Khanna, who is usually inclined towards more conventional stocks in manufacturing, textile, chemicals, and sugar. This impressive stock-picking style has always lured investors.

Today, her portfolio is worth a whopping Rs 4.02 billion (bn), based on corporate shareholdings reported to exchanges on 30 September 2022 for the 22 publicly traded stocks.

Here is the list of the top 5 stocks in Dolly Khanna’s portfolio by highest investments at present in value terms and not volume.

#1 Chennai Petrochemical Corporation

The first stock on the list is Chennai Petrochemical Corporation.

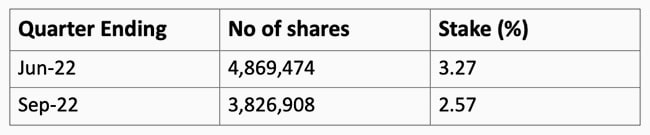

As of September 2022, the shareholding pattern of Chennai Petroleum Corporation shows that Dolly Khanna holds a 2.57% stake in the company or 3.8 m shares in total.

Considering Chennai Petroleum’s current market price of Rs 204.7 as on 28 December 2022, Dolly Khanna’s total value in the company is Rs 783 million (m).

Initially, Dolly Khanna had only bought 0.7% equity in Chennai Petrochemical in March 2022. The deal at that time was valued at Rs 263 m. The shares were acquired through open market operation at Rs 263.1 per share.

Here’s how Khanna’s holding in Chennai Petrochemical has varied since July 2022.

Her investment in the company came in at a time when the Indian Energy outlook report by International Energy Agency (IEA) forecasted demand for crude oil in India to increase from 242 MMT in 2019 to 411 MMT by 2040.

However, after Dolly Khanna bought a stake in Chennai Petrochemical, its share price hasn’t seen much upside. In fact, from July 2022 to 28 December 2022 Chennai Petrochemical’s share price fell by 22.2%.

Chennai Petroleum Share Price Since Dolly Khanna Acquired Stake

In the latest quarterly results, the company reported a 72% YoY decline in net profit on the back of suppressed marketing margins of certain petroleum products.

A spike in crude oil prices following the Russia-Ukraine war and accompanying inflationary pressures kept the oil and gas industry under pressure. The other reason was the levy of windfall taxes.

In July 2022, the government of India announced a windfall tax that negatively impacted oil and gas companies in the country.

Going forward, the company plans to expand its reach in the southern region of India. It has also signed an agreement with Indian Oil Corporation to set up refinery projects in Tamil Nādu.

#2 Polyplex Corporation

Second, on the list is Polyplex Corporation.

As of September 2022, the shareholding pattern of Polyplex Corporation shows that Dolly Khanna holds a 1.17% stake in the company or 0.36 m shares in total.

Considering Chennai Petroleum’s current market price of Rs 1,587 as on 28 December 2022, Dolly Khanna’s total value in the company comes to Rs 548.3 m.

Initially, Khanna bought 322,198 shares of Polyplex in June 2021.

Here’s how her holding has varied ever since she acquired a stake in June 2021.

After her investment in the company, Polyplex’s share price saw a sharp rally on the back of high revenues until April 2022.

Polyplex Corporation Share Price Since Dolly Khanna Acquired Stake

Data Source -BSE

For the September 2022 quarter, the company reported 35% YoY growth in the revenue to Rs 20.9 bn, while the net profit of the company rose by 18.2% to Rs 2 bn.

For Polyplex Corporation, raw materials costs account for about 67% of the total expenditure.

Owing to high raw material prices, the company’s operating margins have been under pressure in the first two quarters of the financial year 2022-23.

To reduce the cost of production, it is focusing on increasing sales based on urbanisation, increasing demand for better packaging, and rising disposable income.

Polyplex is a fundamentally strong company. The company has a low debt-to-equity ratio of 0.28 as of 2022.

Adding to that is its track record for paying consistent dividends. It’s one of the companies with over 7% in dividend yields.

#3 KCP

Third on the list is KCP.

As of September 2022, the shareholding pattern of KCP shows that Dolly Khanna holds a 3.04% stake in the company or 3.9 m shares in total.

Considering KCP’s current market price of Rs 112.5 as on 22 December 2022, Dolly Khanna’s total value in the company comes to around Rs 441.1 m.

Initially, Khanna bought 3.1 m shares of KCP in September 2020.

Here’s how her holding has varied ever since she acquired a stake in September 2020.

After her investment in the company, KCP’s share price saw a sharp rally on the back of a sharp jump in 3profits until August 2021.

KCP Share Price Since Dolly Khanna Acquired Stake

Data Source -BSE

She has gradually increased her stake from 2.4% in September 2020 to 4.3% in June 2021, almost doubling her stake in the engineering company. However, since then share has been continuously reducing her stake in the company.

This reduction in stake can be due to falling profits and revenue of the company.

For the September 2022 quarter, the company reported the revenue decline by 2.7% YoY to Rs 3.9 bn. It reported a net loss of Rs 225.3 m down 174.8% YoY.

The fall in the profits was due to an increase in the raw material expense of the company.

Also, with the rising crude oil prices in 2022, the fuel expense of the company almost doubled, increasing the overall cost of production.

The company is looking forward to expanding its packing capacity to increase its sales.

#4 Sharda Corpchem

Fourth on the list is Sharda Corpchem.

As of September 2022, the shareholding pattern of Sharda Corpchem shows that Dolly Khanna holds a 1.38% stake in the company or 0.9 m shares in total.

Considering Chennai Petroleum’s current market price of Rs 462 as on 28 December 2022, Dolly Khanna’s total value in the company comes to Rs 424.2 m.#

Initially, Khanna bought 1.2 m shares of Sharda Corpchem in March 2022.

Here’s how her holding has varied ever since he acquired a stake in March 2022.

It is one of the fast-growing global agrochemical companies with a leadership position in the generic crop protection chemicals industry.

Dolly Khanna’s big investment in Sharda Cropchem came after its shares price rallied more than 145% in a year, from Rs 284 to Rs 708.

After delivering a multibagger return, the stocks have been trading down since July 2022.

The rally was driven by its asset-light strategy and strong relationships with distributors across key agri-markets of Europe, NAFTA, and LATAM, driving the revenue of the company. 3

However, with currency depreciation and one-off forex losses hitting the company in June 2022 quarter, the company’s shares fell after it reported a 40.5% YoY drop in the net profit.

This decline further continued for the September 2022 quarter. While the revenue of the company for the September 2022 quarter came in higher by 12.3% YoY to Rs 7.2 bn, net profit of the company saw a sharp decline of 62.2% YoY to Rs 120.9 m.

The company, to reverse the decline in profit, is looking to take corrective action to address margin pressures, including increasing hedging and share of buying of raw materials in Euro.

#5 Monte Carlo

Last on the list is Monte Carlo.

As of September 2022, the shareholding pattern of Monte Carlo shows that Dolly Khanna holds a 2.49% stake in the company or 0.5 m shares in total.

Considering Monte Carlo’s current market price of Rs 721.8 as on 28 December 2022, Dolly Khanna’s total value in the company comes to Rs 371.9 m.

Initially, Khanna bought 0.2 m shares of Monte Carlo in December 2021.

Here is how her holding has varied ever since she acquired a stake in December 2021.

After holding the stock for December 2021, her name was missing from the company’s key shareholder list at the end of the March 2022 quarter as her stake slipped below 1%.

This can be attributed to the falling share price of Monte Carlo from January to May 2022.

But with the stock peaking up steam again, Dolly Khanna’s shareholding rose to 1.7% in the company for June 2022 quarter.

This rise in the shareholding by the guru can be attributed to stellar growth in revenue and profit.

In June 2022 quarter, the company registered record sales as cotton prices eased and due to strong store addition. The company opened 11 new exclusive brand outlets (EBOs). It plans to open a total of 30 stores by end of March 2023.

This rise in revenue continued for the September 2022 quarter with a 5% YoY rise to Rs 2.5 bn.

Net profit, however, came in lower by 6.1% YoY at Rs 547.8 m, on the back of increase in raw material cost.

This performance growth in revenue was on the back of end-of-season sales and encouraging festive and wedding season across India.

With the winter season kicking in, the company is set to deliver a robust quarterly result as it dominates the winter segment with more than 50% market share.

The business has a healthy order book for the upcoming summer season.

The company for expansion is trying to increase its presence in the online space.

Which other stocks has Dolly Khanna invested in?

Apart from the above five, here are some other stocks which Dolly Khanna has invested in as of September 2022.

Please note, the source of holdings listed below is from Ace Equity and it may or may not be a complete list of holdings.

Recently we also wrote to you about Vijay Kedia Portfolio top 5 stocks and Ashish Kacholia Portfolio: Top 5 stocks.

Stay tuned to get more updates on investment gurus as we cover more such pieces in the coming weeks.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.