How to Apply for Mutual Funds?

If you are an investor who is looking at the much talked about mutual fund SIPs, there are many ways to apply to them. Many brokers accept mutual fund applications. Apart from this you can also apply directly through the website. Many mutual funds will give you login and password after you register. Remember, you need to comply with Know Your Customer Requirements before you apply. This is also known as KYC Requirement of Mutual Funds. You can also call the various toll free numbers of mutual funds, which can provide you all guidance on how to invest. Understanding the Mutual Fund Schemes Remember, you need to understand the MF schemes before you invest.

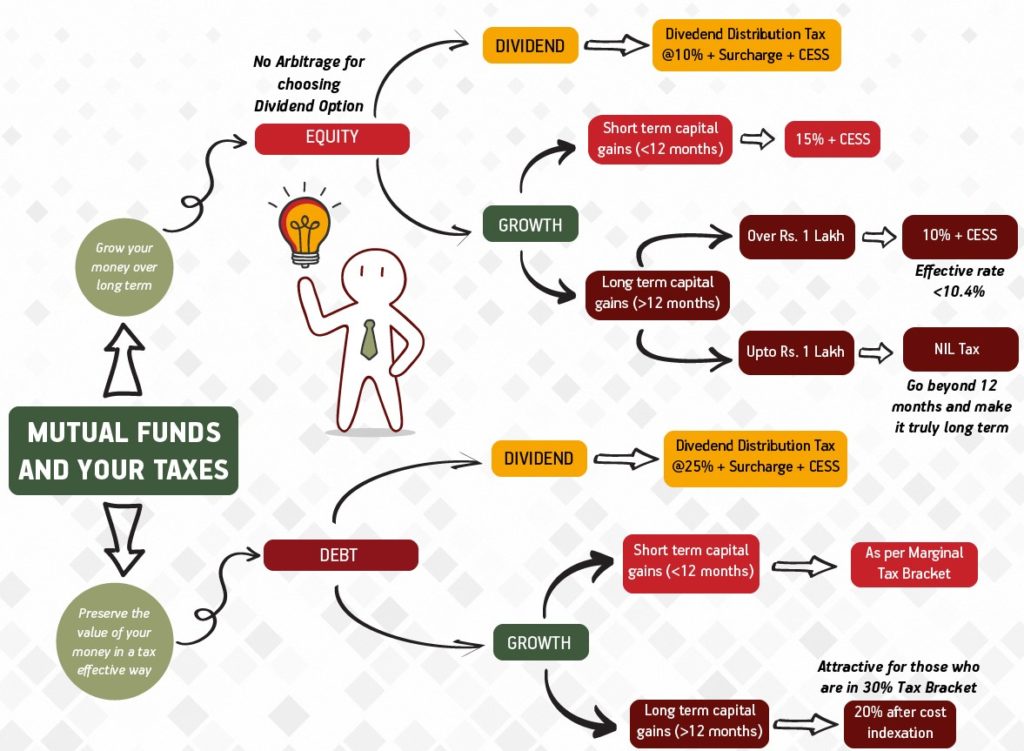

In the above para, we have made aware of how the various schemes operate. What is most important is that investors pick and choose carefully. If you are a person who has retired, it would be dangerous to choose the equity option.You would do well to consider debt mutual funds. Similarly, if you are young and have a steady income flow, opt for SIPs through equity mutual funds.

How does a Mutual Fund work?

Mutual Fund meaning refers to an investment programme which is funded by shareholders which trade in diversified holdings and is professionally managed. A mutual fund generally gathers money from the investor community and the same will be parked into those investments which an investor wants. These funds are generally managed by professional money managers who allocate the funds assets across various investment portfolios and endeavour to produce income or capital gains for the fund’s investors. The mutual funds are more popular because they allow the investor to pick one fund which contains different stocks which are spread out based on the risk-taking capacity of the investor and hence one need not worry about putting too many eggs in one single basket. It also reduces the monitoring of prospectuses or keeping a tab on industry news.

The mutual funds are managed by a fund manager, who picks up all the investments in the portfolio. It is often a big selling point for the beginners who do not have experience and would rather rely on an expert in the mutual fund for investing.

For Example: If an HDFC mutual fund initially comes up with an open-ended equity scheme, then whatever the money it gathers from the investor group from this scheme will be invested in the equity shares. Say if the units were issued at Rs 20, will start inching up if the share prices surge. The Net Asset Value of these units which initially started at Rs 20, will increase gradually. So, it goes up from Rs 20 to Rs 22. Those investors who initially bought these shares at Rs 20 can sell it back to the mutual fund at Rs 22 and reap a profit of Re 2 per share. As it is an open-ended equity scheme, the mutual fund can sell its units constantly at the net asset value. So now, a new investor who did not buy the original initial issue at Rs 20 per share can now buy it at Rs 22 per unit.

List of required things to begin investing in Mutual Funds

The first and the foremost thing required to invest in a mutual fund is to be “KYC compliant”, here KYC stands for Know Your Consumer. This includes submission of photographs, address proof, date of birth proof and a copy of PAN (Permanent Account Number) card. One can either directly approach brokers for making investments in mutual funds or can approach the mutual fund house. One can either opt for considering an equity mutual fund or can go for a debt mutual fund. It is important to update the KYC each and every time when you change your address as it is crucial to stay updated.

Keynote on Mutual Funds

There is a long way to go for mutual fund sector. While its development may seem substantial for a comparatively fresh sector in 2016. It is extremely small at 8.4 per cent as a share of GDP. The way individuals invest, which is a nice indication has been visibly changing. This is due to the growing sector consciousness.

Key Trends And Opportunities

The Indian mutual fund industry’s AUM is anticipated to reach 20 lakh crore earlier than anticipated with reduced bank interest rates and demonetization. Over the next 2-3 years, the mutual fund industry will see solid development powered by possibilities in the below-given field.

Digitalization and Digitization

- Improved delivery efficiencies have increased scope throughout the nation as retailers can now provide clients on the ground with the prepared assessment.

- Seamless client service has been allowed by a range of portable and web applications for monitoring and transacting end-to-end platforms.

- The mutual fund utility has enabled shareholders to position numerous AMC commands and transfer money seamlessly, all thorough a single door.

- E-KYC using Aadhar has proven to be an online investment game changer technology tool and Aadhar will be utilized for multiple public systems in the future.

- Redemption of mutual funds using a debit card offered by two famous Robo advisory systems as well as big investments in houses rendered the payment method more comfortable.

- The completion of mutual fund commissions will help prevent mis-selling, it also promotes customer acquisition innovation and enables cost-effectiveness.

- Special mutual fund distribution commissions in less than 15 cities will increase penetration.

- SEBI proposed that leading e-commerce sites should allow the sale of mutual funds.

Greater Flexibility In Choices

Mutual funds provide a more flexible mix of customer choices and schemes, investment choices and higher tax efficiency. For long term loan, gold and real estate have become unattractive failing to produce decent yields in the last 2-3 years. Instead of shareholders take benefit of SIPs, a rigorous manner to construct long term capital and handle the intrinsic volatility of equity markets, with enhanced knowledge of the mutual fund sector.