What is a mutual fund?

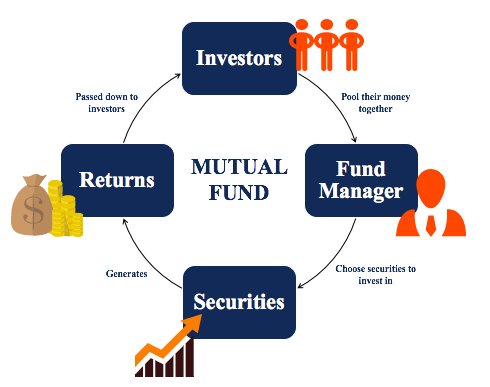

Let’s explain this term in a very simple way. Let’s assume that you as an investor have no idea of shares and stocks. You need professional help and expertise. All you have to do is invest in a mutual fund scheme. A mutual fund scheme collects money from investors and buys and sell stocks collectively.

Let’s give you an example Say, there is a Mutual Fund Scheme called Super Returns Mutual Fund, launched by Super Returns Asset Management Company. What this fund does it comes out with a new offer of a scheme called Super Return Mid Cap Scheme. When it gathers say Rs 100 crores, it invests the money gathered from several investors into the stock markets. If the scheme is an equity scheme it would invest most of its money in shares, while if it was a debt scheme it would invest the same in debt like government securities, bonds etc. Now, the fund will offer you units at Rs 10 initially.

You buy one unit at Rs 10. Say, you buy 1000 units at Rs 10 and you pay a sum of Rs 10,000. One year down the line the stocks invested by the Super Return Mid Cap Fund rise and net asset value climbs to Rs 12. You can now sell the units back to the mutual fund at Rs 12 and you would get Rs 12,000 for your 1000 units. What happens for a new buyer who is interested to buy the units? For a new buyer who is interested to buy the units he would have to buy the units at Rs 12, since the net asset value has climbed.

This means he has to pay Rs 12. In the example below we have tried to make it as simple as possible, assuming that the Super Return Mid Cap Fund is an open ended fund. We have avoided writing on things like entry and exit load, so as to avoid confusing the reader.

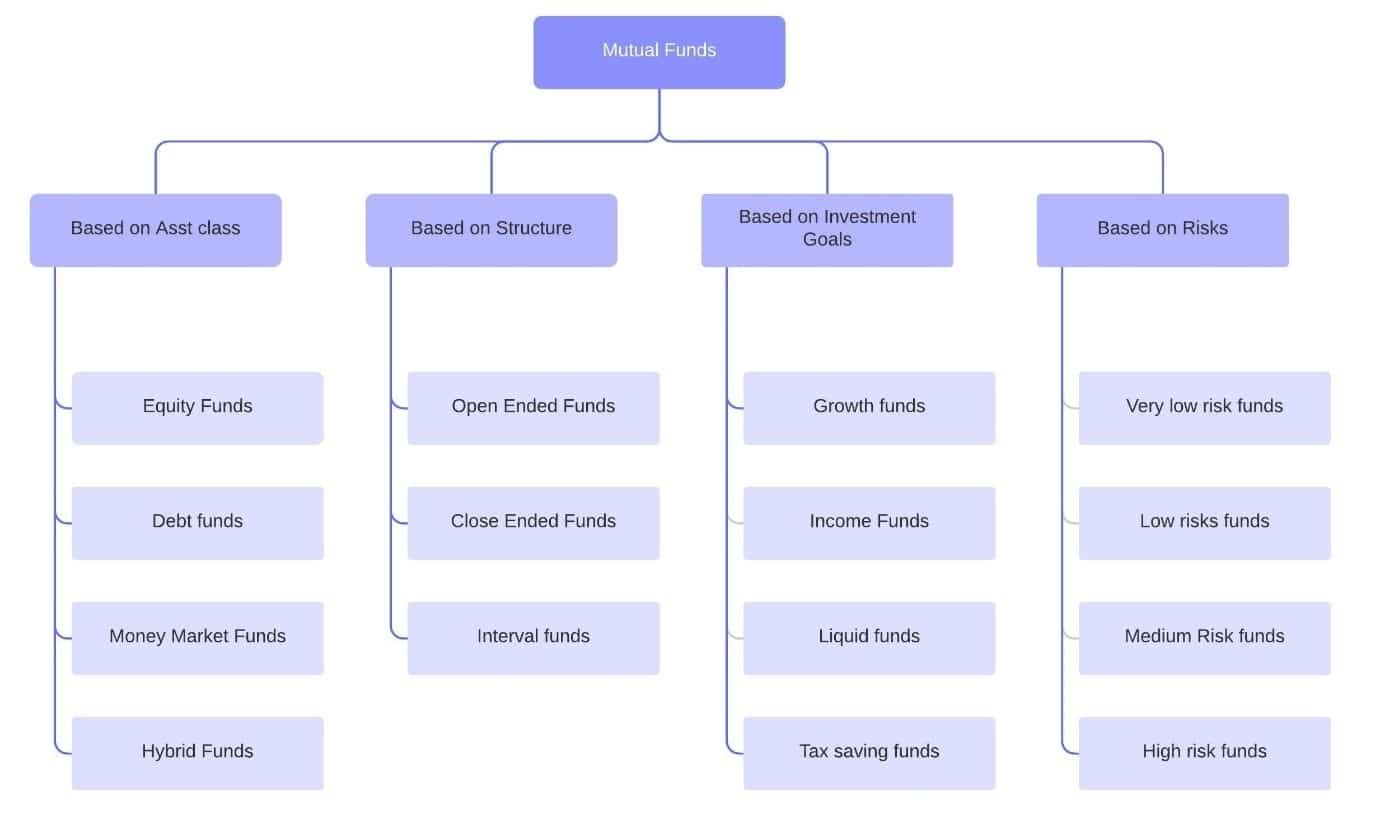

Types of mutual funds in India

Again, we are trying to make it as simple as possible in explaining to you the different types of mutual funds.

1. Equity Funds

Equity funds invest most of the money that they gather from investors into equity shares. These are high risk schemes and investors can also make losses, since most of the money is parked into shares. These types of schemes are suitable for investors with an appetite for risk. Read more articles on Equity Funds.

2. Debt Funds

Debt funds invest most of their money into debt schemes including corporate debt, debt issued by banks, gilts and government securities. These types of funds are suitable for investors who are not willing to take risks. Returns are almost assured in these types of schemes. Read more articles about Debt funds

3. Balanced funds

Balanced funds invest their money in equity as well as debt. They generally tend to skew the money more into equity then debt. The objective in the end is again to earn superior returns. Of course, they might alter their investment pattern based on market conditions. Read More articles on Balanced funds.

4. Money Market Mutual Funds

Money market mutual funds are also called Liquid funds. They invest a bulk of their money in safer short-term instruments like Certificates of Deposit, Treasury and Commercial Paper. Most of the investment is for a smaller duration.

5 Gilt Funds

Gilt Funds are perhaps the most secure instruments that are around. They invest bulk of their money in government securities. Since they have backing of the government they are considered the safest mutual fund units around.